when will capital gains tax rate increase

Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28.

What S Your Tax Rate For Crypto Capital Gains

To fix these problems the inclusion rate for capital gains should rise to 80 per cent from the current 50 per cent.

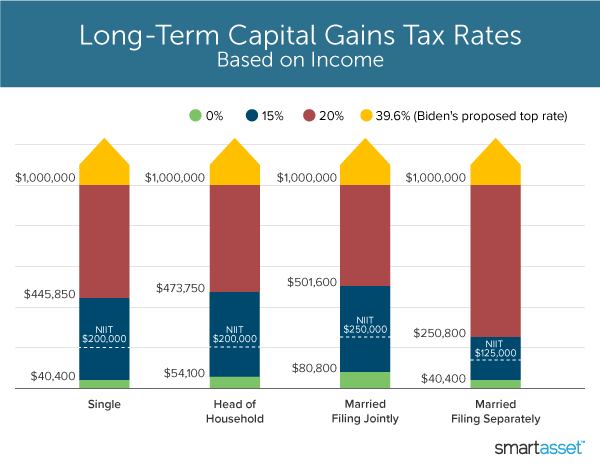

. Capital gains tax rates on most assets held for a year or less correspond to. FAQ on capital gains outlook and effective date. Tax filing status 0 rate 15 rate 20 rate.

In fact Bidens plan to raise the capital gains rate that wealthy Americans pay on profits from the sale of stocks or bonds from 238 to. Since your ordinary income tax bracket is 22 by taking advantage of the lower capital gains tax rates you saved 70 in taxes 150 versus 220 on a 1000 capital gain. For single tax filers you can benefit from the zero percent.

Long-term Capital Gains Tax Rates for 2021. With average state taxes and a 38 federal surtax the wealthiest people would pay. Edged up by more than 7000 in March the first year-over-year increase in almost 10 years.

2021 Long-Term Capital Gains Tax Rates. Capital gains tax would be increased to 288 percent. 22 2021 at 1256 pm.

By Ken Berry JD. When including the net investment income tax the top federal rate on capital gains would be 434 percentRates would be even higher in many US. The tax increases are proposed for the 2022 tax year and there are many significant changes to the tax code that might occur that you need to know.

Capital gains are part of the taxpayers comprehensive income and in a fair and efficient tax system they should be subject to taxation just like other income. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from 238 percent today to 396 percent for higher earners.

Understanding Capital Gains and the Biden Tax Plan. The rates do not stop there. Rate Single Married Filing Jointly Married Filing Separately Head of Household 0 0.

Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently. Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran 2 Capital Gains Tax Hike Would Imperil Active Mutual Funds Bloomberg Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others Higher Capital Gains Taxes Daily Market Update Lpl. Additionally a section 1250 gain the portion of a.

Above that income level the rate jumps to 20 percent. Those tax rates for long-term capital gains are typically much lower than the ordinary tax rates. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends.

2022 capital gains tax rate thresholds tax on net investment income theres an additional 38 surtax on net investment income nii that you might have to pay on top of the capital gains tax. Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment decisions. Long-term capital gains are taxed at the rate of 0 15 or 20 depending on a combination of your taxable income and marital status.

Dramatic increase in IRS capital-gains transactions as Biden administration considers raising tax rates on the wealthy Last Updated. Among the items mentioned in the plan is an increase in the highest tax rate on long-term capital gains and dividends to 25 percent. In addition to raising the capital-gains tax rate House Democrats legislation would create a 3 surtax on individuals modified adjusted gross income exceeding 5 million starting in.

Lily Batchelder and David Kamin using JCT projections estimate that taxing accrued gains at death and raising the capital gains tax rate to 28 percent would bring in 290 billion between 2021. This will affect long-term and short-term capital gains since both would be taxed as ordinary income in the highest bracket. The recent passage of Bill C-208 exacerbates these issues.

In 2022 individual filers wont pay any capital gains tax if their total taxable income is. Taxable income of up to 40400. The Tax Policy Center found that capital gains realization increased by 60 before the capital gains tax was increased from 20 to 28 by the Tax Reform Act of 1986 effective in 1987 and by 40 in 2012 in anticipation of the increased maximum tax rate from 15 to 25 in 2013.

Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income.

Can Capital Gains Push Me Into A Higher Tax Bracket

Biden To Abolish Capital Gains Tax Loophole For Real Estate Investors Real Estate Investor Capital Gains Tax Property Investor

Pin By Sam Dogen On Career Work Capital Gains Tax Capital Gain Financial

Capital Gains Accounting And Finance Capital Gain Finance Investing

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

There S A Growing Interest In Wealth Taxes On The Super Rich

Any Gain That Arises From The Sale Of A Capital Asset Is A Capital Gain This Gain Or Profit Is Comes Under Th Capital Gains Tax Capital Gain Financial Peace

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

How Biden S Capital Gains Tax Increase Will Destroy Innovation Amalfi Coast Positano Amalfi Coast Amalfi

Mechanics Of The 0 Long Term Capital Gains Rate Capital Gain Capital Gains Tax Tax Brackets

What S In Biden S Capital Gains Tax Plan Smartasset

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Learn About What Capital Gains Tax Brackets Are And The Rates Associated With Them Here S A Quick Overview To Get Capital Gains Tax Tax Brackets Capital Gain

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)